Once your utility is submitted, the lender will assess your information and determine your eligibility. Many lenders can present a choice within hours or even minutes, enabling quick entry to funds. However, be ready for probably higher interest rates and charges, particularly in case your credit score score isn't in prime sh

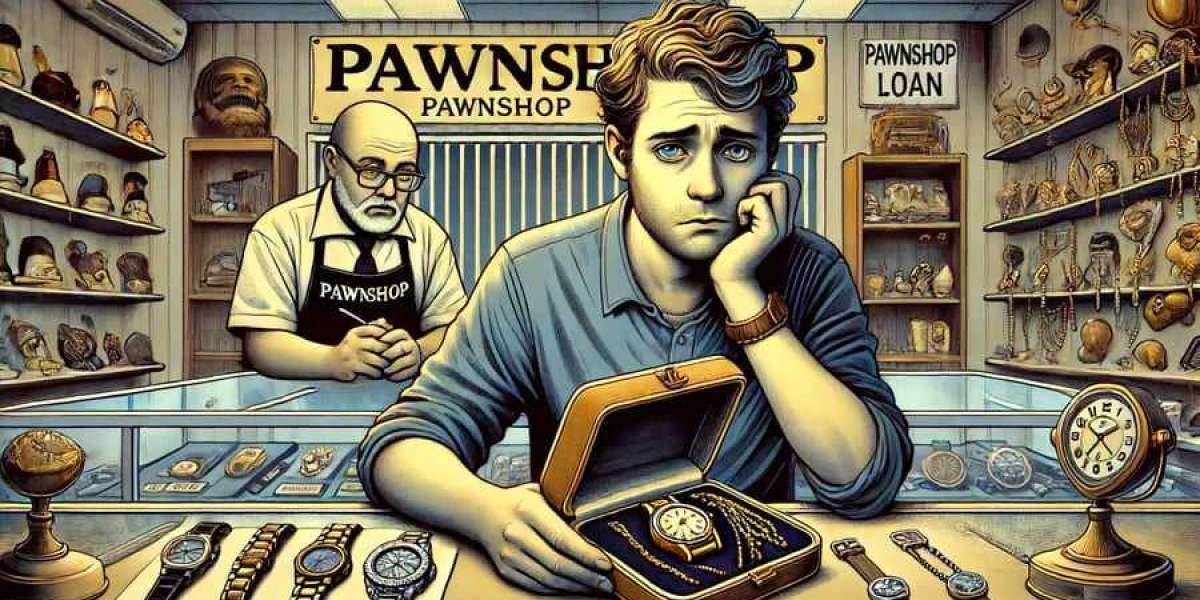

What are Pawnshop Loans?

Pawnshop loans are a sort of secured loan where debtors provide private property as collateral in exchange for money. These loans are often well-liked as a outcome of their accessibility and minimal necessities. Typically, individuals can pawn items such as jewellery, electronics, or collectibles. The lender evaluates the merchandise's value and presents a mortgage amount based on that evaluat

How to Apply for a Debt Consolidation Business Loan

Applying for a debt consolidation loan sometimes includes several steps starting with assessing your present debts and your overall monetary state of affairs. It is advisable to calculate the whole debt amount and gather related documentation, similar to earnings statements and credit reports. This course of will assist determine how much you need and what kinds of loans you should consi

Quality pawnshops will provide transparent data regarding loan phrases, appraisals, and charges. It’s essential to seek pawnshops which might be licensed and controlled to ensure you’re partaking in a fair and protected transact

The Benefits of Debt Consolidation

One of probably the most notable advantages of debt consolidation loans is the potential for a decrease rate of interest. Many customers discover themselves burdened with high-interest debts, notably from credit cards. By consolidating these into a loan with a lower interest rate, they can save a substantial amount over time, which can lead to financial stabil

The compensation timeframe for Emergency Fund Loans can range extensively, ranging from a quantity of months to several years. Interest rates and fees additionally differ based mostly on the lender's policies and your credit rating. Therefore, it is essential to buy around and evaluate completely different options to search out one of the best fit on your wa

These loans sometimes provide a set rate of interest, 이지론 permitting the borrower to learn from predictable monthly payments. The process normally requires good credit, making it important for potential borrowers to know their credit score standing before applying. It’s essential to buy around and evaluate completely different options, as phrases and interest rates can vary considerably among lend

Moreover, pawnshops usually permit borrowers to maintain ownership of their belongings whereas receiving funds. This feature units pawnshop loans aside from different loan varieties the place items are bought immediately. Borrowers can reclaim their objects upon compensation, which may be particularly reassuring for individuals who are hooked up to their possessi

Choosing the Right Lender

Selecting the right lender is crucial to helpful small loan experiences. Prospective debtors should analysis various lenders and their reputations, looking into customer evaluations, interest rates, and phrases of service. Understanding how customer support operates also can provide insights into the lender's reliability and transpare

Finally, failing to consider the long-term implications of borrowing may be detrimental. Review how mortgage funds fit into your month-to-month price range and make certain that compensation is not going to trigger undue financial stress. A clear reimbursement plan can safeguard towards late fees and damage to your credit score sc

n Yes, credit score loans can include utility fees, origination charges, or prepayment penalties that may not be instantly evident. Always learn the mortgage agreement completely before signing and make clear any unclear terms with the lender to avoid surprising co

Finally, at all times learn the fine print earlier than signing any agreement. Understanding repayment terms, interest rates, and potential penalties ensures that debtors are fully ready for their new financial commitm

The concept of women's loans is extra than simply monetary support; it embodies the empowerment and recognition of girls's potential in society. Historically, ladies have confronted limitations in accessing financing, often leading to economic disparity. Women’s loans purpose to bridge this gap by tailoring financial merchandise to fulfill their specific wa

In addition, 베픽 options academic content material relating to the implications of borrowing, potential dangers, and financial administration ideas. These sources are designed to empower borrowers with information, finally resulting in extra responsible lending and borrowing practi

This platform not only lists the benefits of Emergency Fund Loans but in addition highlights potential pitfalls, encouraging responsible borrowing. Their clear, concise articles and user-friendly interface make it straightforward to navigate through completely different mortgage products, helping you evaluate lenders and find the most effective char

jocelynpolitte

45 Blog posts