A Debt Consolidation Loan is a financial product that allows borrowers to mix multiple present debts into a single mortgage. This simplifies the compensation course of by lowering month-to-month payments and probably securing a lower rate of interest, in the end easing the financial burden on peo

Lastly, submitting an software usually consists of offering private data, income verification, and details about existing debts. The overall process can also involve a credit verify, which helps lenders decide eligibility and appropriate phrases for the mortgage. Patience may be essential as some functions will require a big evaluation inter

On the opposite hand, private student loans are offered by banks, credit unions, and different private entities. These loans typically require a credit check and can have variable rates of interest, making them less predictable than federal loans. Students ought to carefully consider their options, as non-public loans might not offer the identical protections or compensation flexibility as federal lo

The Role of 베픽 in Your Loan Journey

베픽 serves as a complete useful resource for those looking for information about Day Laborer Loans. The website offers not solely detailed explanations of assorted loan products but in addition presents structured reviews that highlight the professionals and cons of various lenders. This unique perspective can streamline your decision-making proc

Tips for Managing an Emergency Loan

Managing an emergency mortgage successfully is crucial to make certain that it does not result in further monetary misery. Borrowers should establish a repayment plan as soon as the loan is permitted. This plan ought to account for the repayment schedule and the loan te

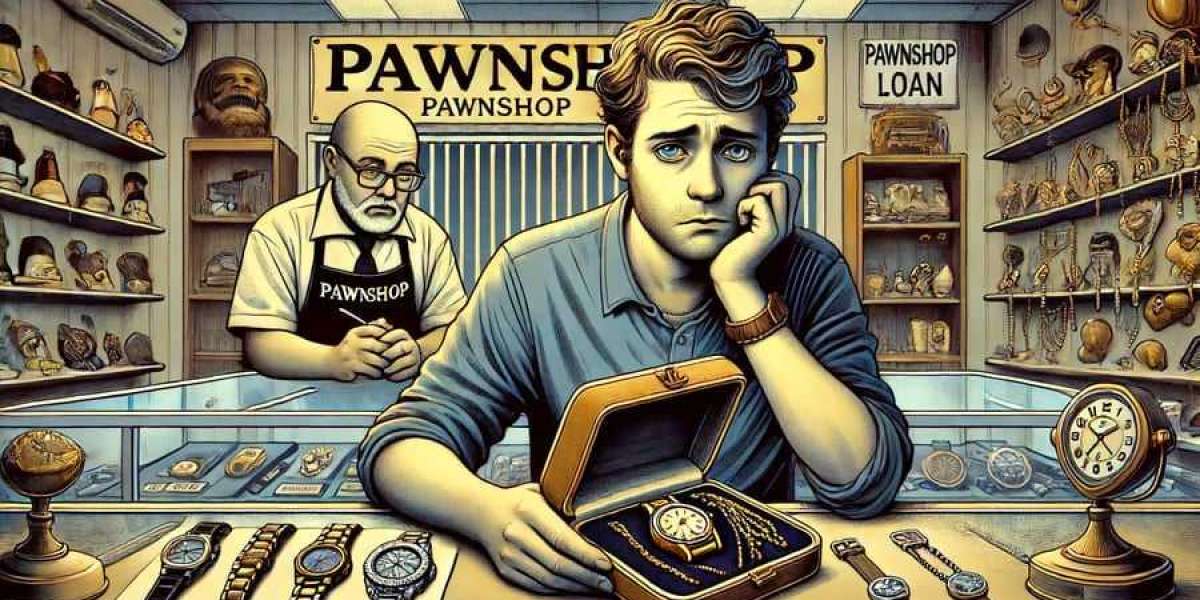

Another concern is the risk of not valuing the collateral appropriately. Pawnshops might not always present a good market worth for the objects provided, which means borrowers could receive less cash than what their items are price. Additionally, the emotional worth attached to non-public items could make it tough for some individuals to relinquish them, further complicating the decision-making course

Moreover, managing a single fee eliminates the problem of maintaining observe of a quantity of due dates, considerably reducing the likelihood of missed or late funds. This structured method to repayments not only enhances budgeting capabilities but in addition fosters higher credit score administration over t

The Benefits of Low-Credit Loans

One of the primary advantages of low-credit loans is their accessibility. Unlike conventional loans, which often require a great credit score, these loans present opportunities to those that might in any other case be excluded from borrowing. Additionally, they can help people rebuild their credit score scores if managed responsibly. By making timely payments, debtors can improve their credit score health and improve their chances of securing favorable loans in the fut

Student loans are an important topic for lots of people pursuing greater training. The monetary burden that accompanies tuition and dwelling expenses typically necessitates the necessity for exterior funding sources. This article explores the intricacies of student loans, together with varieties, application processes, compensation options, and the impression of rates of interest. Additionally, we'll introduce 베픽, a comprehensive useful resource that provides in-depth info and critiques on student loans to assist students make knowledgeable selections about their monetary fut

To improve and maintain a healthy credit rating, individuals ought to concentrate on paying bills on time, maintaining bank card balances low, and avoiding pointless debt. Regularly monitoring credit score stories for inaccuracies also can help be sure that issues do not negatively influence borrowing capabil

What Are Emergency Loans?

Emergency loans are sometimes small, short-term loans designed to assist individuals manage unexpected bills. They could be secured or unsecured and are often processed shortly to provide instant monetary assistance. The key features of those loans embody flexibility in use, quick approval instances, and easy application proces

The software normally involves filling out personal information, demonstrating the ability to repay the loan, and specifying the purpose of the loan. Many lenders require documentation such as income verification or financial institution statements. Once the appliance is submitted, debtors can expect a quick decision—sometimes as soon as the identical day—to tackle their pressing monetary wa

What Are Low-Credit Loans?

Low-credit loans, usually designed for these with poor credit scores, allow people access to funding when conventional lenders may deny them. These loans might are available in varied varieties, corresponding to Personal Money Loan loans, installment loans, or 이지론 payday loans. They is often a crucial monetary resource for those trying to cover surprising bills or who lack entry to other types of credit score. However, potential debtors ought to be conscious that these loans typically have greater interest rates, reflecting the elevated risk to lend

debora87w03014

5 Blog posts